What Happens to Collectibles During Inflation? Using Collectibles as a Hedge When Cash Loses Value

Although the dollar bill rises and lowers overtime and in an instance with inflation, collectible items act way differently. Many people invest in these items and use them like stocks and bonds. They search out high ticket items to keep safe and sound within their own homes.

When inflation rises, and money value decreases, these collectibles get sold for the same price or even more than they would have before. Why do collectibles act this way? How can you use collectibles as a hedge against inflation when cash loses value? Follow along in our blog as we dive into these factors and show just how you can get the most value for your items and how collectibles behave differently when inflation hits.

Join Us in Seeing What Happens to Collectibles During Inflation

Follow along with us as we dive into our blog on collectibles and inflation. First we will mention what makes collectibles so valuable. This includes the condition of the item, rarity, and demand. Next, we will dive into why collectibles act differently than cash.

This includes the lack of interest, fees, limitations in quantity, the factor of an alternative investment, and the global appeal. Join us and find out for yourself just how to use your collectibles to hedge against inflation.

What Makes Collectibles So Valuable?

Many things take into the account for what makes collectibles so valuable. Sure, not all collectibles hold high values. Many of them simply sell for fifty dollars or less. However, some collectibles sky rocket in values as high as tens of thousands of dollars.

Why does this happen? Some reasons why collectibles rise in value include the quality and condition of the item. Other reasons include factors such as nostalgia and demand of the items at certain points in time. Continue following along as we mention each of these separately and dive in deeper.

Condition

The condition of collectibles plays a huge role into the value of these items. Because of this, any damage done to the items significantly decreases the value. Even little things such as UV rays from sunlight or open air and oxygen harms items, turning them yellow over time.

This often happens to action figures and bubble packaging due to the plastic material breaking down. With the yellowing, this also causes the items to become more fragile and easily breakable. Along with this, any scratches from dust or handling reduce the value. Faded colors, paint chips, broken pieces, and missing parts also make the item lower in value since the condition is not as high.

This is why graded items often hold higher values. They remain mint in their boxes with all pieces intact and tape still securing the flap to open the box. These items remain unused and in great condition. With grading companies, too, people send these items in to receive a number grade for how good the condition is.

This allows the collector to receive documentation on the item's authenticity. It also helps the collector keep the item in good condition since grading companies specifically choose to seal items in acrylic packaging to keep dust off and to keep it safe from any handling that may harm and damage it.

When owning a collection and trying to keep its value, it is important to keep up with the maintenance of the items. This includes regularly cleaning them properly by dusting them or by carefully wiping off any debris. Also, keeping items in safe storage unharmed from rough handling or any outside damage keeps your collected items in good condition. Display cases, totes, and climate controlled storage all help out in this area.

Rarity

Next up, we will mention the importance of rarity when it comes to the value of collectibles. Many collectibles are very rare. This is often what makes them collectibles in the first place. Some companies only release a small amount of items for a certain period of time as limited editions which makes them rare since only certain people own them.

Along with this, the date of release plays a factor since older items often show damage or go missing over time. Very few of the mass produced items often still remain in good condition and reach to high values. Even some items that didn't hit initial popularity among their release hold to high values now due to the spike in demand and desire to own these items. Often times if they didn't hit initial popularity, they only released for a short amount of time which makes them rare, especially years later.

Demand

Now, we dive into the importance of demand. Within the vintage and collectible market, the value of items may go up or down due to the demand of an item. For instance, nostalgia plays a huge factor into demand. It also keeps markets such as these still running when people find these items they used to love again and desire to add them to their collection.

Collectors search far and wide for specific items, causing the demand of them to rise and the value of them to rise as well. People often will spend a lot of money on items that they remember and miss from their childhoods since these items give them nostalgia and joy from the memories that go along with them.

Also, the vintage toy market and other collectible markets are all sentiment-driven. This makes items easily desirable due to their rarity and nostalgia as well as the condition of the items. All of these factor into how the demand goes up and why it adds to the value of collectible items.

Also, this means that to some extent, certain items will rise in value during high demand times but will fall in value when the demand drops. For instance, the beanie babies of the 1990s hit initial popularity and some grew to incredibly high valued items the next decade. However, now these same items only cost a few dollars each and don't hold the same value they once did.

Why do Collectibles Differ From Cash?

Next up on our blog we will dive into why collectibles differ from cash when inflation hits. This is such a big thing to notice as you can use these items to hedge against the inflation. Factors such as different fees that come with selling items, limitations in quantity, and the global appeal all factor into this main point. Continue following along with us as we remain going through these factors.

No Interest

One thing to notice with collectibles is that they do not generate income just by sitting there. Although collectibles often get sold and purchased as investments by people due to their value, these items only generate value when sold. Some people use stocks or bonds as wise investments yet with these, there are sometimes factors to take in when inflation hits.

Especially for high valued items in collections, these often still keep their high value over time if they remain in good condition. Because of this, when inflation hits and the value of the dollar decreases, collectible items still hold their values and can be sold to hedge against inflation. These items don't drop in value when sold because it is the item that holds the value.

The demand of the buyer and the condition of the item also determine how much the collectible will be sold for. Collectibles are investments that often keep their value and only rise or decrease with wear and damage or demand.

Fees

This next factor, fees, plays a big role in hedging against inflation as well. When it comes to selling collectibles, extra fees are required or helpful in transporting the items and figuring out how to best protect them along the way. Some insurance can be helpful for protection purposes but also adds more fees to the overall process for the buyer.

Along with this, shipping costs add extra fees especially for bigger and more valuable items. These typically add to the overall expense but help out both the buyer and the seller. These fees give a hedge to the buyer since they are purchasing a valuable item that will be used most likely as an investment.

Then, for the seller, these fees give a hedge since the overall expenses rise with extra costs. The seller gets the most bank and the buyer gets an investment to keep that can help hedge against inflation later on.

Limitations in Quantity

Another way that collectibles differ from cash when inflation hits is from the fact that they are so rare. Previously we mentioned this rarity and how it adds to the value of items when they remain in good condition. Since collectibles are often only sold for short periods of time or are no longer in production, they act way differently than cash.

These items are limited in quantity across the world due to the damaging of items or loss over the years while others didn't release many to begin with. When looking at inflation, currency devalues when more are in circulation. On the opposite end, there are all different kinds of collectibles and all appear differently so the small amount remaining in circulation hold high values and sometimes even rise in value during inflation. They can no longer produce more of these exact items to meet the demand which makes them very valuable.

Alternative Investment

Another reason that collectibles differ from cash is that they are used as an alternative investment. Yes, people enjoy collections for purposes such as nostalgia and as a hobby. However, many people also search out those high valued items to add to their collection for the purpose of investing. They know that these items give a hedge against inflation and that they often keep their values rather than fluctuate or go down in value.

Some people also invest in things such as stocks and bonds which are great investments. Collectibles still work a bit differently than these investments due to the fact that they can stand more steady in value and don't gain interest.

Global Appeal

The last factor we will mention for why collectibles differ from cash includes the global appeal. Collectibles get sold all over the world every day. With technology and online web sources today, we now have the ability to connect with people all around the world.

People today use this tool for even things such as buying and selling items and then shipping them to other countries and overseas. Because of this, the value of the items often stays the same across the board. Different countries have different economies and some see inflation more often than others. Regardless, they all act differently and change at different times.

These collectible items still keep their value since many people around the world may be looking for that exact item as well and the demand cannot be met if the items are no longer in production. This makes collectibles so much more valuable to anyone around the world.

Final Thoughts

When inflation hits and currency circulates more but goes down in value, the opposite is true of these collectibles. They are often used as investments and help hedge against inflation. They act differently than cash and assist to give a safe fall back when prices for everyday items rise significantly in value.

Do You Have Old or Used Toys?

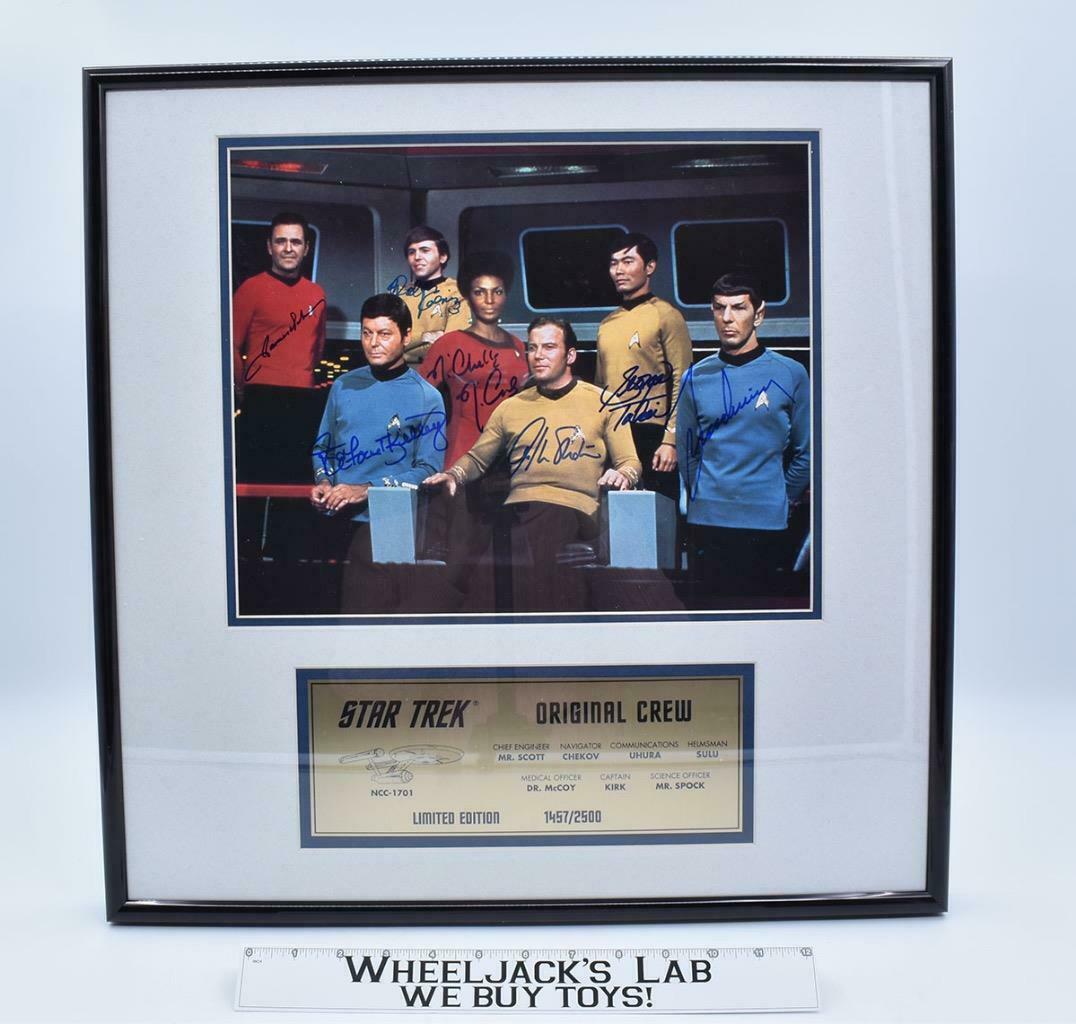

Don’t let your collection sit in storage gathering dust—turn it into cash! At Wheeljack’s Lab, we specialize in evaluating and buying vintage and used toys, from single standouts to entire collections.

Our friendly, expert team has decades of hands-on experience in collectible toys, so you can expect honest evaluations and a smooth process from start to finish. Ready to sell? Call us at 888-946-2895 and let’s get started.

About the Owner, Chris Ingledue

Chris is the founder and owner of Wheeljack’s Lab Pop Culture and Toy Shop. His vision has always been to reconnect collectors with the toys and pop culture that shaped their childhoods—sparking memories, nostalgia, and imagination along the way.

Each day in the “Lab” feels like Christmas year-round. From scouring the internet for the next great treasure—much like flipping through the Sears Catalog of years past—to eagerly awaiting the postman’s arrival like Santa himself, Chris lives and breathes the thrill of the hunt. Helping collectors around the world experience their own version of Christmas is what makes being a vintage toy buyer an absolute joy.